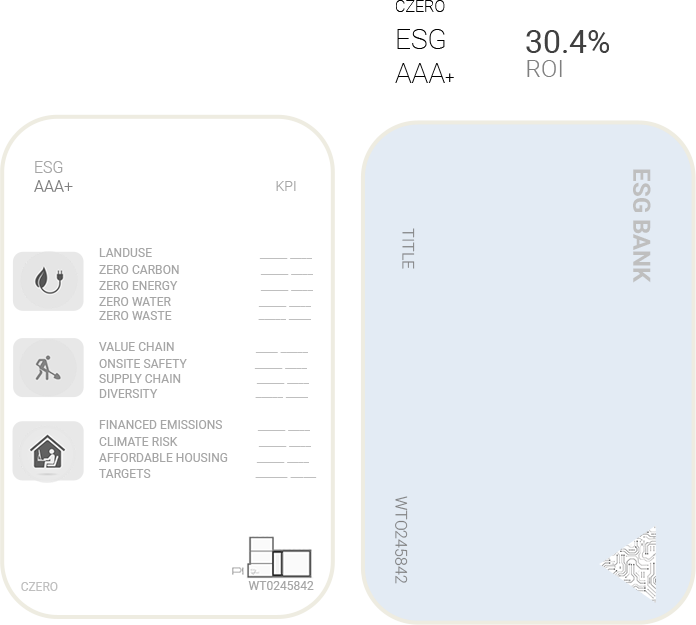

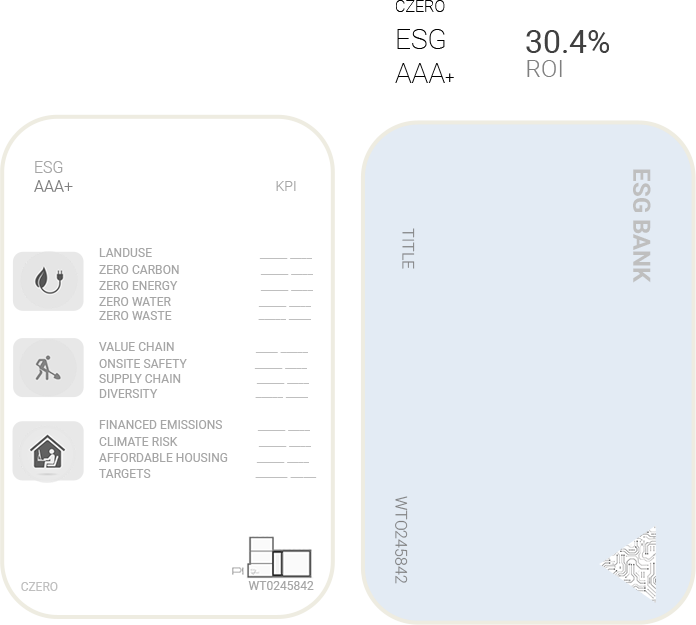

ESG-Grade

Commercial Real Estate

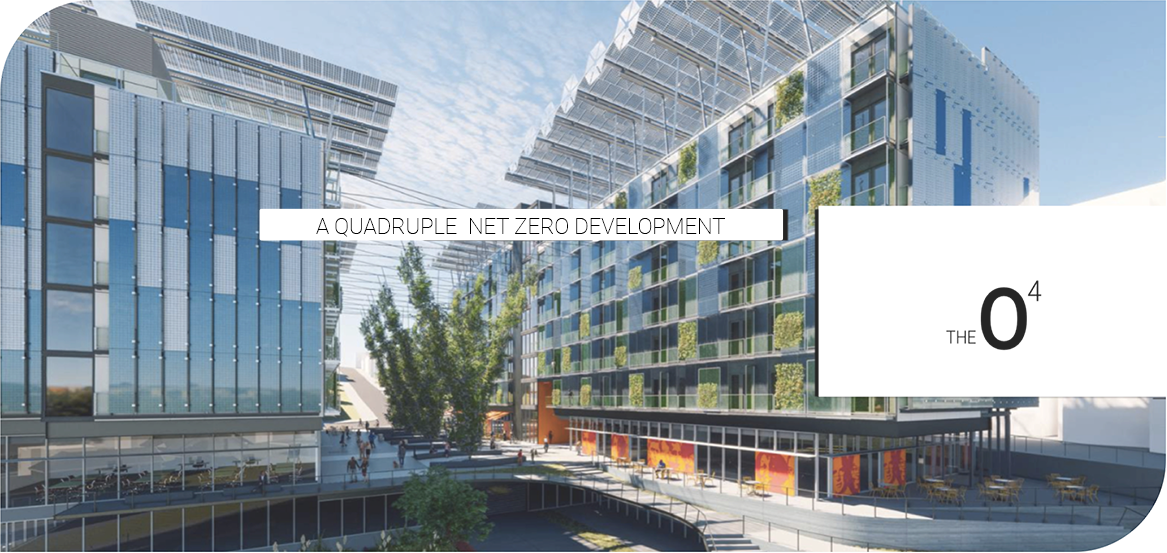

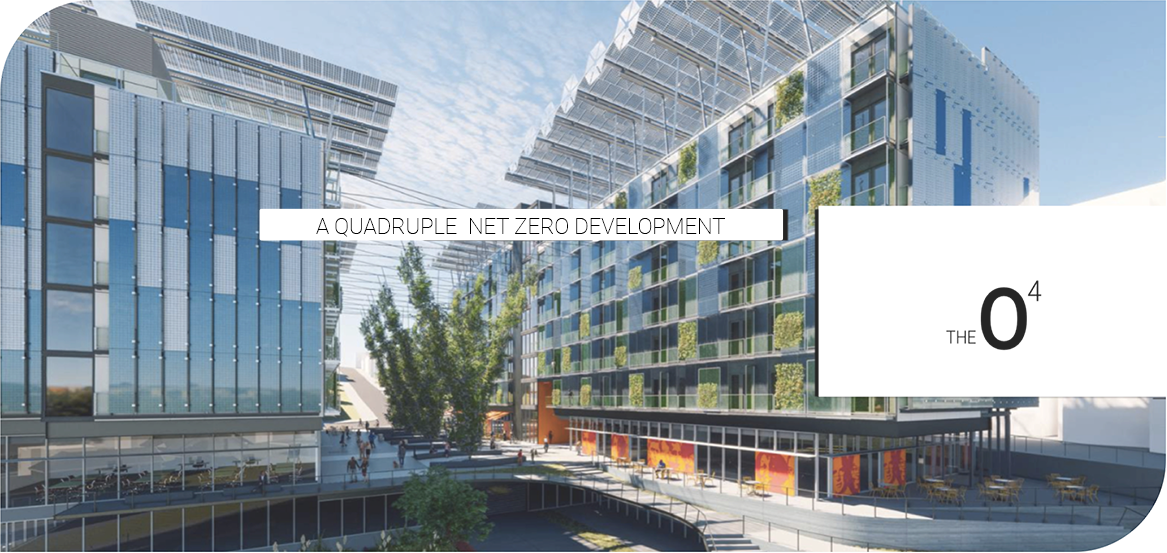

Meet 04

swipe up

NEED MORE?

Visit czero.pro/assets &

Request full project file

Meet 04

Visit czero.pro/assets &

Request full project file